How to get crowdfunding for business

Crowdfunding has emerged as a revolutionary way for entrepreneurs and startups to raise funds for their business ventures. Whether you’re looking to launch a new product, expand an existing business, or simply bring a creative idea to life, crowdfunding for business can be a powerful tool to secure the capital you need.

This comprehensive guide will walk you through the ins and outs of crowdfunding, providing actionable insights, tips, and resources to help you navigate the process successfully.

Understand the Types of Crowdfunding

Crowdfunding is a method of raising funds from a large number of people, typically via online platforms. Instead of seeking a large sum from a single investor, crowdfunding allows you to gather small contributions from many supporters. These supporters are often referred to as “backers” or “investors,” depending on the type of crowdfunding.

There are four main types of crowdfunding

1. Reward-based Crowdfunding: Backers receive a tangible item or service in return for their support. This is popular for creative projects and product launches.

2. Equity-based Crowdfunding: Backers receive a share of the business in return for their investment. This type is ideal for startups looking to raise significant capital.

3. Donation-based Crowdfunding: Backers donate money without expecting any return. This is commonly used for charitable causes or social enterprises.

4. Debt-based Crowdfunding (Peer-to-Peer Lending): Backers lend money with the expectation of being repaid with interest. This is often used by small businesses looking to avoid traditional loans.

Why Crowdfunding for Business is a Game-Changer

Crowdfunding for business offers several advantages over traditional funding methods:

Access to Capital: Crowdfunding allows you to access capital without relying on banks, venture capitalists, or other traditional investors.

Market Validation: By gaining support from backers, you can validate your product or idea in the market before launching.

Building a Community: Crowdfunding helps you build a community of loyal supporters who are invested in your success.

Marketing and Exposure: A crowdfunding campaign doubles as a marketing tool, helping you generate buzz and visibility for your business.

Steps to Launch a Successful Crowdfunding Campaign

Launching a successful crowdfunding for business campaign requires careful planning and execution. Here are the key steps to follow:

1. Define Your Goals and Objectives

Before launching your campaign, it’s essential to define your goals. What do you want to achieve with crowdfunding? Whether it’s raising funds to launch a new product, expand your business, or enter a new market, having clear objectives will guide your campaign strategy.

2. Choose the Right Crowdfunding Platform

Selecting the right platform is crucial for your campaign’s success. Some popular platforms include:

Ketto: A leading platform in India, Ketto is known for its versatility in supporting various campaigns, from personal fundraising to business ventures. Ketto funding and Ketto fund raiser are terms often associated with successful crowdfunding initiatives in India.

Kickstarter: Ideal for creative projects, Kickstarter is one of the most popular reward-based crowdfunding platforms.

Indiegogo: Offers more flexibility than Kickstarter, allowing both reward-based and equity-based campaigns.

Seedrs and Crowdcube: Focus on equity-based crowdfunding, suitable for startups looking to attract investors.

GoFundMe: Primarily donation-based, GoFundMe is often used for charitable causes but can also be used for business funding.

Each platform has its own fee structure, audience, and campaign requirements, so choose the one that best aligns with your goals.

3. Create a Compelling Campaign Story

Your campaign story is the heart of your crowdfunding for business campaign. It should clearly communicate:

The Problem: Identify the problem or need your business addresses.

The Solution: Explain how your product or service solves the problem.

The Impact: Highlight the positive impact your business will have on customers, communities, or the environment.

The Funding Need: Be transparent about why you need the funds and how you plan to use them.

Use visuals, such as images and videos, to make your story more engaging. A well-crafted story can significantly increase your chances of attracting backers.

4. Set a Realistic Funding Goal

Your funding goal should be realistic and aligned with your business needs. Consider the following factors:

Production Costs: Calculate the costs involved in producing your product or service.

Marketing Expenses: Factor in the costs of promoting your campaign.

Platform Fees: Most crowdfunding platforms charge a fee (usually 5-10%) on the total funds raised.

Contingency: Include a buffer for unexpected expenses.

Setting a realistic goal increases your chances of reaching it and creates a sense of urgency among backers.

5. Offer Attractive Rewards or Incentives

For reward-based crowdfunding, offering attractive rewards is key to motivating backers. Rewards should be:

Unique: Offer something exclusive that backers can’t get anywhere else.

Tangible: Provide physical products or services that backers can look forward to receiving.

Tiered: Create multiple reward tiers to cater to different levels of support, from small contributions to larger investments.

In equity-based crowdfunding, the incentive is typically shares in your business. Ensure that the terms are clear and legally sound.

6. Promote Your Campaign

Promotion is critical to the success of your crowdfunding for business campaign. Here are some strategies to consider:

Leverage Social Media: Use platforms like Facebook, Twitter, Instagram, and LinkedIn to spread the word about your campaign.

Email Marketing: Send regular updates to your email list to keep them engaged and informed.( To know email marketing read this Article)

Influencer Marketing: Collaborate with influencers in your industry to reach a wider audience.

Press and Media: Reach out to local and industry-specific media outlets to feature your campaign.

Consistency is key. Regularly update your backers and keep the momentum going throughout the campaign.

7. Engage with Your Backers

Engagement doesn’t end once you’ve raised funds. Keep your backers informed and involved throughout the project. Provide regular updates on the progress of your business, and if there are any delays or changes, be transparent about them.

Building a strong relationship with your backers can lead to long-term support and even repeat funding for future projects.

Legal and Financial Considerations

Before launching your crowdfunding campaign, it’s essential to understand the legal and financial implications:

Regulations: Depending on your country and the type of crowdfunding you’re using, there may be specific regulations to comply with. For example, equity-based crowdfunding often requires adherence to securities laws.

Taxes: Crowdfunding income may be subject to taxes, depending on your location and the type of campaign. Consult with a tax advisor to understand your obligations.

Intellectual Property: If your business involves proprietary technology or ideas, ensure that your intellectual property is protected before sharing it publicly.

Case Studies of Successful Crowdfunding for Business

Studying successful crowdfunding campaigns can provide valuable insights and inspiration for your own campaign. Here are a few notable examples:

These examples demonstrate the potential of crowdfunding for business when executed effectively.

Resources for Further Learning

To deepen your understanding of crowdfunding and increase your chances of success, consider the following resources:

Books:

“The Crowdfunding Bible” by Scott Steinberg: A comprehensive guide to crowdfunding strategies and best practices.

“Crowdfunding for Entrepreneurs” by Lucy Gower: Focuses on how startups can leverage crowdfunding to raise capital.

Online Courses:

Udemy: Offers several courses on crowdfunding, including “Crowdfunding for Startups & Entrepreneurs” and “Kickstarter Crowdfunding Masterclass.”

Coursera: Provides courses like “Entrepreneurship: Launching an Innovative Business,” which includes a module on crowdfunding.

Websites:

Ketto: Learn more about crowdfunding in India and start your own campaign at [Ketto.org](https://www.ketto.org).

Kickstarter and Indiegogo: Explore successful campaigns and gather inspiration for your own project.

Common Mistakes to Avoid

Avoiding common pitfalls can significantly increase your chances of a successful crowdfunding for business campaign:

Lack of Preparation: Insufficient planning is one of the main reasons campaigns fail. Take the time to research, plan, and prepare before launching.

Setting Unrealistic Goals: Overestimating your funding needs or setting an unattainable goal can discourage potential backers.

Poor Communication: Failing to keep your backers informed can lead to dissatisfaction and negative feedback.

Neglecting Legal and Financial Considerations: Ignoring legal or financial obligations can lead to serious consequences down the line.

Conclusion

Crowdfunding for business offers a unique and powerful way to raise funds, validate your product, and build a community of loyal supporters. By understanding the different types of crowdfunding, choosing the right platform, and following the steps outlined in this guide, you can increase your chances of a successful campaign.

Remember, the key to a successful crowdfunding campaign lies in preparation, clear communication, and engaging with your backers. With

the right approach, crowdfunding can provide the financial boost your business needs to thrive.

Whether you’re launching a new venture or looking to expand an existing business, crowdfunding is an accessible and effective way to achieve your goals. Start planning your campaign today and take the first step toward turning your business dreams into reality.

This article provides a detailed roadmap for anyone looking to explore crowdfunding for business. By following the steps and strategies outlined, you’ll be well on your way to launching a successful crowdfunding campaign and securing the funds needed to bring your vision to life.

Thanks for reading this article. Please motivate me for more such article by just reading my other articles too.

Thank YOU!!

-

Meet Alibaba’s Ai Qwen 2.5-Max: The Chatbot Conqueror

Qwen 2.5-Max

-

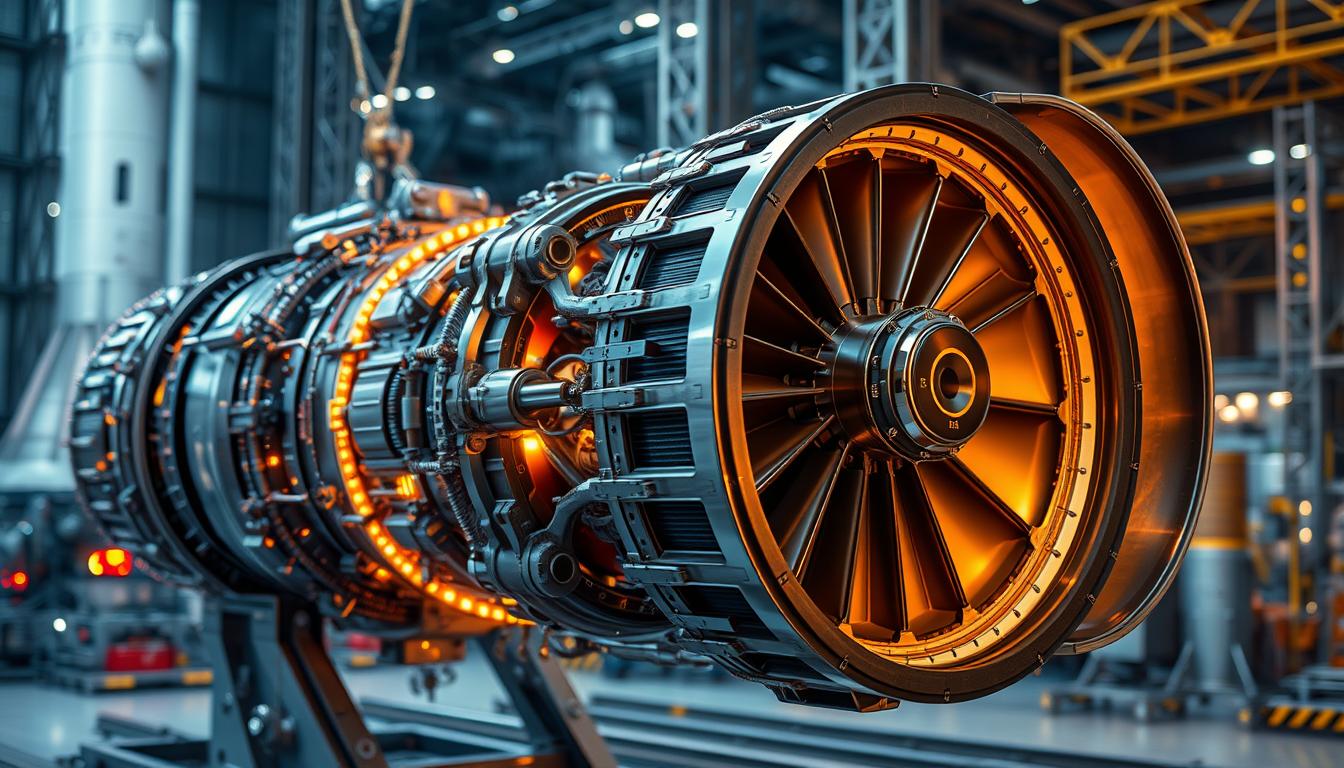

SpaceX Raptor Engine Schematic: Inside Look

Explore the intricate details of SpaceX’s revolutionary propulsion system with our comprehensive spacex raptor engine schematic analysis. Uncover its innovative design and capabilities.

-

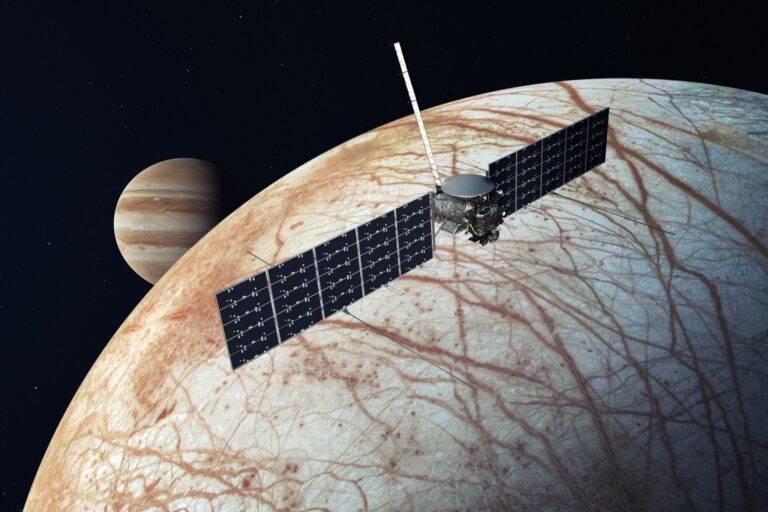

SpaceX Raptor Engine Horsepower Revealed

Unleash the potential of SpaceX Raptor engine as we reveal its horsepower. Discover the true power behind SpaceX’s cutting-edge technology in this how-to guide.

2 Comments